When checking the authenticity of a credit or debit card, knowing which networks and card types are supported is crucial. MR Checker makes this easy by supporting a wide range of card types from major global networks. Users can rely on it to identify Visa, MasterCard, American Express, Discover, and other card issuers accurately and instantly.

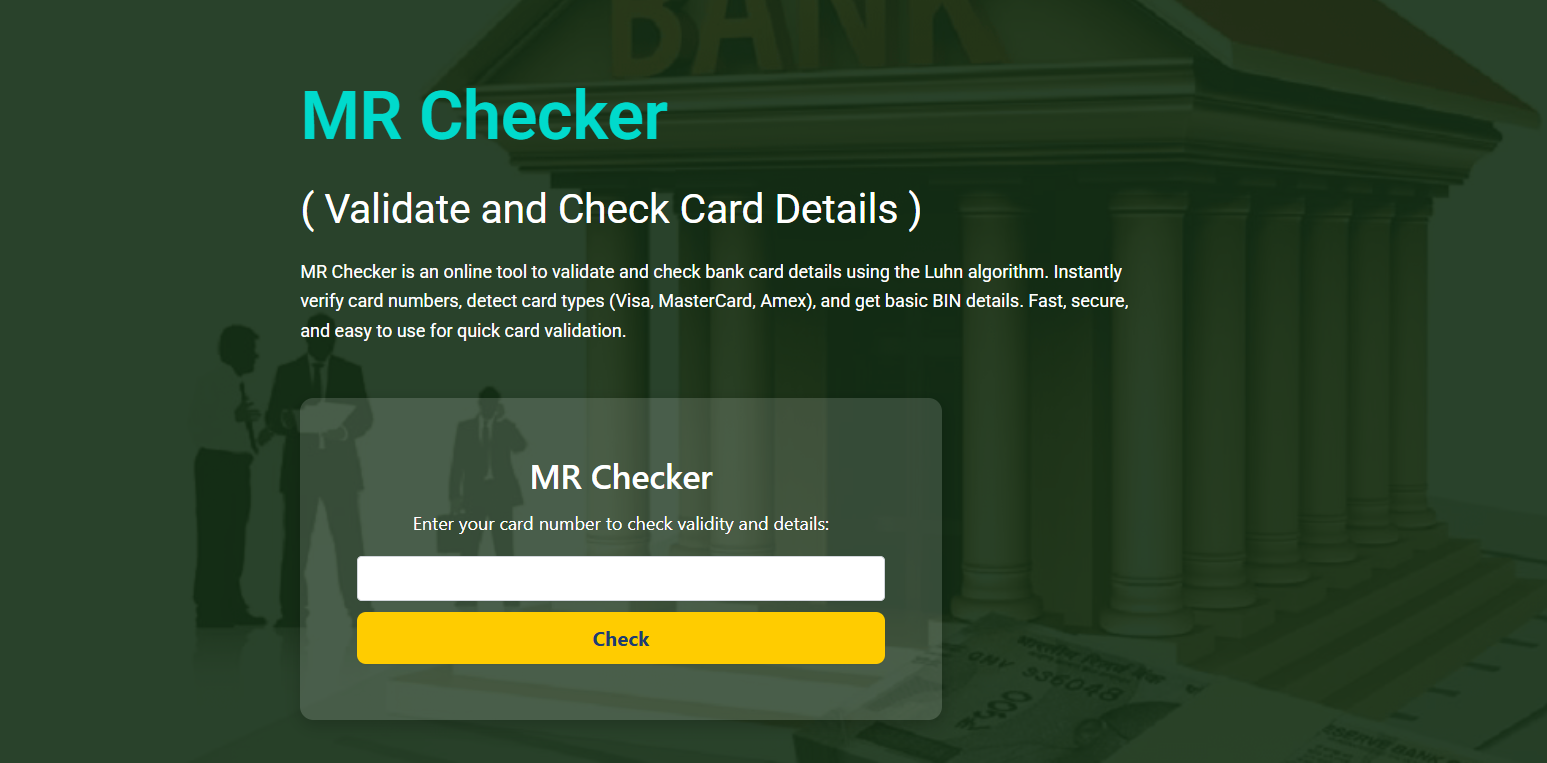

With a simple card number input, MR Checker analyzes the digits and delivers structured results based on its up-to-date BIN database. It ensures compatibility across a variety of card formats, giving users a dependable tool for real-time card identification without requiring registration or payment.

Major Supported Card Networks

Visa Card Identification

MR Checker instantly identifies Visa cards using the first few digits (the BIN) of the card number. Visa cards typically start with a 4, and the system is trained to detect these patterns accurately. Once a number is entered, MR Checker returns details such as card brand, issuing bank, and country.

Visa’s global reach makes it one of the most checked card types. MR Checker ensures consistent identification of whether the card is Classic, Platinum, or another tier, helping users confirm its legitimacy in seconds.

MasterCard Compatibility

MasterCard is another widely used card brand that MR Checker handles seamlessly. These cards generally begin with a 5 or 2, and the platform is capable of identifying all valid MasterCard ranges. It offers instant feedback on card type and issuer info.

Whether you’re verifying a corporate card or a prepaid MasterCard, the tool accurately displays the brand and issuing bank, making it suitable for personal, business, or testing purposes.

American Express and Discover

MR Checker also supports less common but still critical networks like American Express and Discover. American Express cards usually start with 34 or 37, while Discover cards begin with 6. Both are recognized and categorized by MR Checker, offering users a full profile of the card.

This broad compatibility allows MR Checker to serve global users working with various card types. It ensures smooth validation whether you’re in North America, Europe, or beyond.

Specialized Card Identification

Corporate and Business Cards

MR Checker detects business-issued cards that may fall under specialized BIN ranges. These cards often have unique levels (such as World Elite or Corporate), and the system is designed to return these specifics clearly.

This helps finance teams and vendors confirm that a card is linked to a company or organization, supporting better transaction transparency and control.

Prepaid and Gift Cards

Prepaid debit cards and gift cards often fall through the cracks with other validators, but MR Checker includes them in its scope. Whether the card is issued by a traditional bank or a third-party provider, the tool identifies its BIN correctly.

This feature is especially useful for businesses accepting non-traditional payments and for users managing multiple card types.

International Card Issuers

MR Checker supports card identification from banks and institutions outside the U.S. as well. It reads BIN data to determine the issuing country and shows whether the card originates from Europe, Asia, the Middle East, or elsewhere.

This international recognition is valuable for global merchants and developers who need to validate a wide range of cards from different regions.

MR Checker accurately identifies cards such as:

- Visa (Classic, Platinum, Signature)

- MasterCard (Debit, Credit, Corporate)

- American Express (Green, Gold, Platinum)

- Discover Cards (Standard, Cashback)

- Prepaid, gift, and reloadable cards

Accuracy Behind Card Identification

Powered by Verified BIN Databases

MR Checker uses an actively updated BIN database that stores the identification data of millions of cards. It cross-checks every card number against this database to ensure precise recognition of the card brand, type, and issuer.

The accuracy of card identification reduces errors and prevents false assumptions. It also helps users decide whether to accept or reject a transaction based on origin or card level.

Automated Pattern Detection

Each card type follows a unique number structure. MR Checker uses logic to recognize these sequences instantly. It processes the number and aligns it with known patterns to quickly identify the card type without delay.

This automation allows users to validate cards in real-time and makes the tool scalable for repeated or bulk use.

Benefits of accurate card detection:

- Reduces fraud risk by flagging invalid cards

- Supports financial compliance and verification

- Enhances user experience with clear results

Use Cases for Wide Card Detection

E-commerce and Online Stores

Online sellers benefit from knowing which card types their systems accept. MR Checker helps identify card networks quickly, letting sellers flag unusual cards before completing the transaction.

This can prevent payment failures, chargebacks, or fraud attempts and also helps with payment gateway testing.

Developers and Payment Systems

For developers testing payment systems, identifying a variety of cards is essential. MR Checker assists by verifying test cards and real ones during sandbox setups. It ensures that the payment flows behave correctly for different card types.

With its open-access model, developers can run multiple tests without being limited by usage caps or logins.

General Users and Small Businesses

Small business owners or individuals verifying card authenticity will find MR Checker helpful. Whether you’re suspicious of a transaction or simply curious, the tool delivers immediate answers about the card’s source.

It serves as a free, easy-to-use resource for anyone needing clear card data in seconds.

MR Checker supports use by:

- Fraud prevention teams

- App testers and QA engineers

- Small businesses verifying customer cards

Conclusion

MR Checker supports a wide range of card types, from popular networks like Visa and MasterCard to specialized and international cards. It detects corporate, prepaid, and gift cards with ease and accuracy, giving users dependable insights into any card’s origin and classification. Backed by a regularly updated BIN database and a secure interface, MR Checker simplifies card validation for developers, merchants, and everyday users looking for quick, reliable answers.